Last year Lynda H had the opportunity to move to Spain for a year. Her son's childhood friend, Nick, seemed like the perfect tenant to rent her house while she was away. He was single, no pets, had a stable job and she had known him since he was a kid. Because she knew him well, she thought she could forego the formalities of a standard agreement. She did not run a credit or background check, she didn't require a security deposit and they signed a simple one-page agreement stating the terms of the lease. As Linda got ready to travel, she handed the keys to her property to Nick and instructed him to deposit the rent in her bank account on the 1st of each month. During the next 12 months, Nick paid Linda only two months worth of rent, caused significant damage to her property and refused to move out until Linda was forced to take him to court. A tenant from hell is not always easy to spot. Make sure you are diligent when handing the keys to your property. Run a thorough screening of the potential tenants including a credit report, a criminal background check, eviction records and check references for prior residency and employment.

0 Comments

U.S. Supreme Court will hear an appeal from Bank of America. The lender claims underwater Fla. owners shouldn't be able to "strip off" second-mortgage debt.

Read More... Debts may be removed from a credit report for various reasons and the fact that it is removed from a credit report does not mean that it is no longer enforceable by law. The same way, just because a debt is on a credit report does not mean that it is still enforceable by law. So in essence, yes, you can be contacted by a creditor or debt collector regardless of the way in which the account shows up on your credit report.

There are two laws that apply to debts being legally reported to credit bureaus and debts being legally collected. The first one is the seven-year reporting limit on most debts that is enforced through the Fair Credit Reporting Act. The second one is the statute of imitations regarding how long a consumer is legally responsible for paying back a debt. According to the Federal Trade Commission, the statute of limitations on a debt is effected by the type of debt and individual state laws. The statute of limitations only applies to a collector who is trying to sue for a debt. According to the FTC, a collector can still contact a debtor about a past due account even after the statute of limitations has expired, but the debtor is no longer legally obligated to pay. If a debtor pays any money on a past due debt, that is sometimes reason enough to legally restart the statute of limitations and enable the debt collector to sue the consumer. When reviewing your credit report, make sure that you recognize the accounts and loans on your credit report as accounts that you have opened. Then check that the information reported by each of the creditors on your credit report is correct. If you find information that you believe is not correct, contact the company that issued the account or the credit reporting company that issued the report.

Some common warning signs of identity theft are:

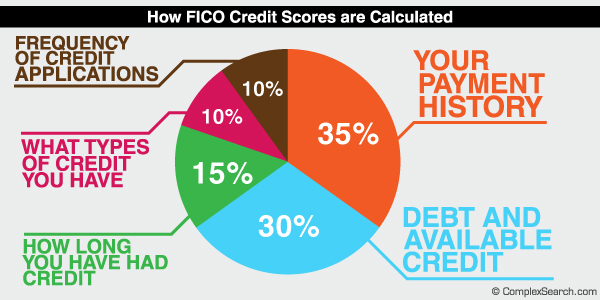

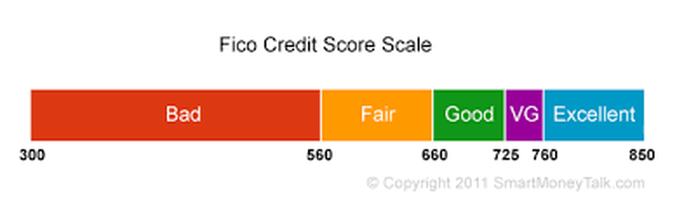

When searching for a home to rent, a tenant may consider the location of a property, its distance to their job, amenities, the area's crime rate, local attractions or whether it has carpet or tile, however, one of the most important factors for a landlord when considering accepting an offer from a prospective tenant, is his credit history.

According to a recent survey conducted by TransUnion, 43 percent of landlords surveyed said they perform credit checks as part of the leasing process and 48 percent of landlords surveyed said the results of a credit check are among the top three factors used when deciding whether or not to accept a tenant's lease application. Additionally, more than two-thirds (69 percent) of renters surveyed said they will not purchase property in the next four years.* As a tenant, it is important that you keep watch over your credit history. Get a copy of your credit report regularly, dispute any inaccurate information such as incorrect mailing addresses, misspelled names, inaccurate account information, etc, identify problem areas and set a payment plan. If there are unpaid bills that you feel require an explanation, consider adding a consumer statement. As a landlord, visit Verify Tenant to check for a tenant's criminal history, eviction records, verify their employment and past rental history. * extracted from http://newsroom.transunion.com/press-releases/transunion-reveals-almost-half-of-landlords-consid-1114781#.VCjz7fldXpU Beginning May 29th, Verify Tenant’s ordering platform will feature a bunch of system performance enhancements. Among the enhancements we are most excited about are:

Applicant Phone Number: On the Applicant Pending records, when you hover over the Detail icon, the Applicant’s phone number is now included in the display Federal Criminal Update: Federal Criminal and Civil searches can now be conducted State-wide for all Federal Districts within a selected State. New Look & Feel: Our development team has been updating the Order Entry Wizard System Performance: We have added server capacity, server memory, installed new servers and added a system monitoring tool that helps us identify and target slow processes. With this tool, we are making a number of software optimizations and database service enhancements. www.verifytenant.com A class action lawsuit has been brought against a California employer for allegedly failing to comply with state and federal mandates when obtaining information from background checks during its hiring processes. Real Estate investments come in all shapes and colors. You may be a landlord who owns one property and rents it out, you may be into flipping a few properties a year, or you may the owner of an entire complex. However small or big your investment portfolio, or your strategy, one thing is for sure, you need tools to help you make a savvy decision. In today’s recovering real estate market, there are a realm of tools available to help you search for properties, but once you are faced with options, how do you decide which properties make sense? How do you take the emotion out of buying? The latest entrant in this business is Flipt, which aims to take some of the emotion out of real estate purchase decisions and replace it with a more data-driven approach.

Read more …. By Verifytenant.com |

Archives

February 2023

Categories

All

|

RSS Feed

RSS Feed