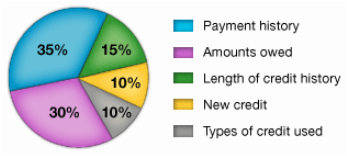

Whether you are looking to buy or rent a property, your credit history and your credit score can play a major role in determining the terms you receive on your financing terms or moving requirements. Your credit history and score reflect your credit worthiness in the eyes of a landlord or lender. When a landlord is asked to trust that you will make prompt payments every month in exchange for a allowing you to reside in a property he has placed a vast amount of money in as investment, or when a lender is asked to loan money, they run a credit report to determine the amount of risk involved in investing in you as an applicant. In case of a rental, the amount of money required from you to move in, or the leverage you may have to negotiate down the amount required as move-in costs (advanced rent and security deposits), depend in big part on your credit worthiness. Loan approval, the amount of money you are eligible to receive and the terms of the financing provided are some of the most critical elements of your real estate transaction and they depend almost entirely on your credit record. This is why it is so important to understand how credit scores are calculated. Although credit score calculation is a bit of a mystery and calculated based on a proprietary algorithm developed by FICO, it is estimated that your credit score is calculated based on a few different factors. These are broken down below by percentage of consideration:

0 Comments

Beginning July 1st, Florida Statute 83.683 requires that landlords who require a rental application as part of the approval process to rent out a property, must complete the processing of said application within seven days from submission when the applicant is an active service member and must notify the prospective tenant whether approval or denial is issued. If the landlord fails to provide an approval or denial within the specified time frame, then Florida law requires that the landlord leases the property to the applicant, provided that all other lease and application provisions are met. This new law applies not only to individual landlords, but also to condominium associations, cooperative associations and homeowners associations. Keep the new law in mind when choosing your tenant screening company. Verify Tenant provides immediate access to criminal background checks and tenant credit checks.  It wasn't until Vladimir Kholodnyak was found throwing cigarettes over the third-floor condo balcony and drinking out of glass bottles on the pool deck of the Avant Garde condominium in Hallandale, FL, that the condominium and the landlord began digging for information, only to discover the tenant was in fact an international criminal wanted by the Interpol. Florida's warm weather brings hundreds of new residents to its shores each month, many of whom are making the property they are renting, their first US home. A new resident has no criminal history recorded in the National criminal database, therefore condominiums and landlord are limited as to what type of investigative information they can gather from a prospective tenant. Verify Tenant has a solution for you! we specialize in offering international criminal reports, so no matter where your prospective tenant comes from or the fact that they haven't resided in the US before, we can provide a comprehensive criminal search from their country of origin. Read the full story |

Archives

February 2023

Categories

All

|

RSS Feed

RSS Feed