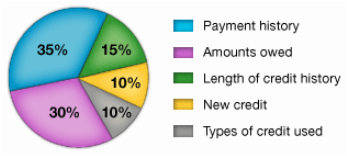

Whether you are looking to buy or rent a property, your credit history and your credit score can play a major role in determining the terms you receive on your financing terms or moving requirements. Your credit history and score reflect your credit worthiness in the eyes of a landlord or lender. When a landlord is asked to trust that you will make prompt payments every month in exchange for a allowing you to reside in a property he has placed a vast amount of money in as investment, or when a lender is asked to loan money, they run a credit report to determine the amount of risk involved in investing in you as an applicant. In case of a rental, the amount of money required from you to move in, or the leverage you may have to negotiate down the amount required as move-in costs (advanced rent and security deposits), depend in big part on your credit worthiness. Loan approval, the amount of money you are eligible to receive and the terms of the financing provided are some of the most critical elements of your real estate transaction and they depend almost entirely on your credit record. This is why it is so important to understand how credit scores are calculated. Although credit score calculation is a bit of a mystery and calculated based on a proprietary algorithm developed by FICO, it is estimated that your credit score is calculated based on a few different factors. These are broken down below by percentage of consideration:

0 Comments

Leave a Reply. |

Archives

February 2023

Categories

All

|

RSS Feed

RSS Feed