|

Becoming a landlord can be a lucrative business or a mad nightmare, depending on whether you treat your property investment as a business and make smart choices or treat it as a hobby. A big part of having real estate investments that are profitable, is ensuring you have quality tenants.

3 Comments

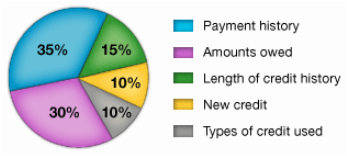

Oh, the credit score. That almost mystical three-digit number that determines our financial faith. Whenever you want to obtain a loan, whether it is a credit card, a car loan, or a mortgage, the lender will check your credit report to determine how likely you are to pay them back in full and on time. Not only will your credit history determine whether you will get the loan, but it will also help dictate the terms of the loan, such as the amount of money you will get and at what interest rate.

Every real estate investor knows that a rental property that sits vacant is a bad investment. But do you know what is an even worse investment? A property rented to a bad tenant. A tenant who skips rent or trashes your property can cost you plenty, so making sure you vet prospective tenants carefully, is key to maintaining a healthy portfolio along with your sanity. Asking prospective tenants to fill out a rental application, checking their background and credit check, and calling past landlords, places of employment and other references, is a great start. But what about tenants who lie or omit the truth in their applications? Some tenants may look great on paper, however, they may have lied or stretched the truth to appear to be a more appealing candidate. Some of the things potential tenants tend to like about, and that you should take a closer look into are:

America is a nation of home buyers. Owning a home is the original American dream, but when the growth in home prices outpaces the growth of rental prices and people find themselves paying more than necessary just to be able to live somewhere, the alarms start going off for signs of a bubble. Four years ago, home prices fell sharply in major US cities, rental prices increased and the market shifted in favor of buyers. Now, rent growth is flattening out and according to the National Index tracked by FAU and FIU faculty, home-price appreciation has outpaced rent growth in 23 metroploitan areas, signs of a market that is trending back in favor of renters. Although no evidence of a bubble exists, for the first time in a few years, renting is beginning to look like a much better alternative than buying. If you are a landlord, get ready for an influx of tenants looking to move into your properties. Being well informed and equipped with facts from credit reports, background checks, eviciton records and other tenant screening reports is key to a succesful investment.  Once the new president elect Donald Trump takes office in January 2017, things might become increasingly difficult for immigrants if he were to hold true to his campaign. During the presidential election campaign, Trump promised mass deportations of undocumented immigrants living in the US and to build a wall along the border with Mexico. Since the election, the number of people fleeing to the US from Central America has increased dramatically in hopes of entering the country before the borders become harder to cross. This drastic surge will generate an additional demand for affordable rental properties. In recent reports released by the National Association of Realtors, international buyers are shifting their investments from luxury properties to less pricey properties. Will this be enough to meet the new demand? If you are an investor, beefing up your portfolio with affordable rental properties may just be the winning ticket and being able to verify tenant’s criminal records from their country of origin through our international criminal database, will give you some peace of mind and help you get acquainted with your new potential tenants, who don’t yet have a history in the US.  As if the process of renting an apartment wasn't complicated enough, and as if the requirements imposed by landlords weren't stringent enough, roughly 100 million Americans find it even harder to obtain access to adequate housing. We are speaking about the one-third of American adults who due to having some sort of criminal record, despite of having been rehabilitated, are denied from residency by most landlords. Criminal records, financial problems and less-than-ideal rental histories, all records that have become easily accessible, are factors that most landlord tend to use in order to disqualify a potential tenant. According to HUD, landlords can become entangled with the law themselves by violating the Federal Fair Housing Act if their residency-restricting rental policies affect individuals of a particular race, national origin or other protected classes, in a disproportionate manner. In a joint effort between NeighborWorks America, which contributed a $75,000 grant towards a study on the issue, and nonprofit landlords Aeon, CommonBond Communities, Beacon Interfaith Housing Collaborative and Project for Pride in Living the four are attempting to find ways to shrink this growing segment of so-called unrentables, including reevaluating their approval and denial criteria, such as determining more carefully which crimes are disqualifying factors, the length of time since the conviction and whether the applicant poses a threat to the safety of others.  Credit scores are a funny thing (not funny haha, but funny weird). You need to be indebted in order to build up your credit history, but doing so, puts you in a risky position. If you want to buy a house, a car or get a student loan, you need to have built your credit history, so millions of Americans spend their financial lives doing this dance in which they have little to no knowledge of the steps. Let's imagine you are a responsible American and you open a handful of accounts. You charge a few things and pay them off on time at the end of each month (just to build up your credit, you know). You then charge some more, but instead of paying the balance at the end of the month, you pay the minimum charge. It was a tough month after all with having had to replace the tires in your car. When you least expect it, it has been months since you have paid a dime over your minimum payment and your balance isn't going down, so you make a plan to pay off the debt. A year later, you've been disciplined and you've managed to pay off your credit card debt. Your balance is now zero. Should you close the account then? I mean, you don't want to get back in debt, do you? Don't be so quick. Before you decide to close an account with a debtor, consider this: One of the major components of your credit score is what is knows as credit-utilization rate (balance to limit ratio). When you close an account that has a zero balance, you essentially lose the available limit in that account, causing your overall utilization rate to go up and your credit score to dip. If all your other accounts are positive, your score will typically bounce back after a few billing cycles. If you are thinking of closing an account, consider two things - When will you need your credit score. If you are planning to finance a house in the next 3 to 6 months, do not close the account - How much of your overall available credit does that account represent? If the account in questions represents a small portion of your overall available credit, closing it could have very little impact, but if the account represents a large portion of your credit history, then the negative impact could be significant. - How long has the account been open for? The length of time you've had the account in questions open has an impact on your credit score and closing an account that has a long history may negatively affect your score.  According to a recent national survey sponsored by the Consumer Federation of America, consumers often underestimate the significance of their credit scores and, other than the basics, know very little about them. Millennials, which are individuals aged between 18 and 34 are the least knowledgeable about credit scores, compared to members of the generation X. They lack the knowledge to determine what a good credit score might be and only 51% of them have ever obtained a free credit score for themselves, a number significantly to lower to that of the genXers, who stand at nearly two thirds. "While the credit scoring industry is always innovating and changing, practicing good credit behaviors and understanding the basics about your credit score are fundamentally important," says Barrett Burns, president and CEO of VantageScore Solutions, which offers consumers an interactive credit score quiz to test their knowledge so they can make the right financial decisions in order to maintain a good credit standing.  After years of seeing double-digit increase in rental prices across the U.S, renters are beginning to see a much more moderate rise. Additional building is giving renters more options and adding to the country's housing supply, having added 310,300 multi-family buildings last year, a 21.4% growth from 2014, according to figures from the Commerce Department. The result? A median rent rise of a seasonally adjusted 2.6% in June of 2016, compared to the previous year, a number that matches the increase in average hourly wages, according to data gathered reported by Zillow. Certain cities, such as New York City and Los Angeles, continue to report rises above the national average, however, rental costs in most suburban areas have decelerated after years of consistently exceeding earnings growth. The median monthly rent nationwide was $1,409. Shelter accounts for a third of all consumer expenses, according to the consumer price index, which is why this moderation in rental price jumps can be so valued by consumers.  Whether you are looking to buy or rent a property, your credit history and your credit score can play a major role in determining the terms you receive on your financing terms or moving requirements. Your credit history and score reflect your credit worthiness in the eyes of a landlord or lender. When a landlord is asked to trust that you will make prompt payments every month in exchange for a allowing you to reside in a property he has placed a vast amount of money in as investment, or when a lender is asked to loan money, they run a credit report to determine the amount of risk involved in investing in you as an applicant. In case of a rental, the amount of money required from you to move in, or the leverage you may have to negotiate down the amount required as move-in costs (advanced rent and security deposits), depend in big part on your credit worthiness. Loan approval, the amount of money you are eligible to receive and the terms of the financing provided are some of the most critical elements of your real estate transaction and they depend almost entirely on your credit record. This is why it is so important to understand how credit scores are calculated. Although credit score calculation is a bit of a mystery and calculated based on a proprietary algorithm developed by FICO, it is estimated that your credit score is calculated based on a few different factors. These are broken down below by percentage of consideration:

|

Archives

February 2023

Categories

All

|

RSS Feed

RSS Feed